Arise of Asset-Light Living of GenZ,India

Gen Z in India — born between 1997–2012 — is embracing rental, shared, and asset‑light living more than ever. Let’s explore why this shift is happening, backed by market data and research, while keeping SEO‑rich keywords in focus.

What Is Asset‑Light Living?

Asset‑light living refers to renting furniture, appliances, cars, co‑living units, and more — rather than owning them. It offers flexibility, saves upfront costs, and aligns with digital, urban lifestyles — especially for Gen Z.

Startup & Real‑Estate Trends Driving the Shift

Co‑Living Boom

The co‑living market in India is valued at ₹40 billion in 2025 and is projected to scale roughly five‑fold to ₹206 billion by 2030. Source: India’s co-living sector poised for massive growth; inventory set to triple by 2030

- Managed rentals and shared living appeal to millennials & Gen Z for community‑centric flexibility and lower costs.

Rental Furniture & Appliances

- Asia Pacific leads with over 35% of the global home‑appliances rental market, and India is growing fast.

- Millennials and Gen Z especially value “own fewer possessions” as a lifestyle choice.

Online marketplaces such as NobuyRent, Furlenco, Rentomojo, Cityfurnish are growing in the face of increasing demand.

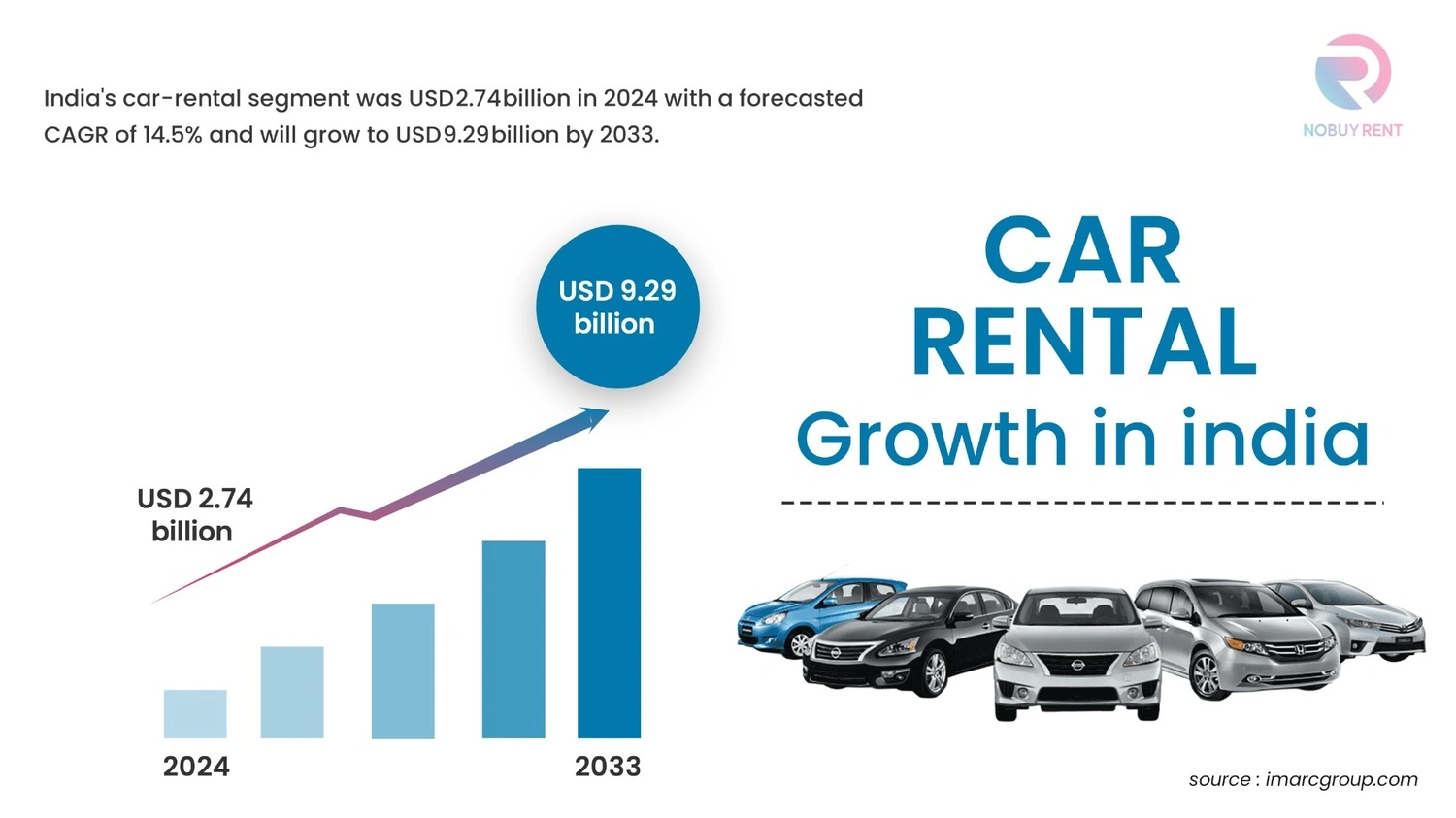

Mobility & Car Rentals

- India's car-rental segment was USD 2.74 billion in 2024 with a forecasted CAGR of 14.5% and will grow to USD 9.29 billion by 2033.

- Increased disposable incomes + need for flexibility + tech platforms are driving this trend.

Why Gen Z Prefers Asset‑Light Living

1. Flexibility & Mobility

Career mobility, remote work, and urban migration mean Gen Z values dynamic living — not long-term commitments.

2. Cost‑Efficiency

Co‑living is 20–35% cheaper than traditional rentals in metro cities — e.g., Bengaluru rates are ₹11.7–23.7k vs ₹15.5–36.5k for 1BHK units.

Avoidance of high deposits and downpayments is a big plus.

3. Community & Convenience

Shared amenities like Wi‑Fi, housekeeping, laundry, and social events appeal to Gen Z — especially those new to cities.

4. Sustainability & Experience

It is more environmentally friendly to own less. Access to first-rate experiences without the hassle of ownership is provided by renting.

The Role of Asset‑Light Platforms

- Furlenco, a pioneer in furniture rentals, started in 2012 and raised over $30 million—showing investor confidence.

- Stanza Living (70,000+ beds across 23 cities) and Zolostays (operating in 10+ cities) illustrate growth in co‑living.

- These companies operate on asset‑light models: leasing properties, optimizing spaces, and subletting — minimizing capital expense and accelerating scale.

How NobuyRent Serves Gen Z

- Platforms such as www.nobuyrent.com strategically position themselves in this asset‑light ecosystem: Rent items like Furniture, appliances, and gadgets

- Rent-to-return options

- Flexible tenures from days to months

- Seamless delivery, installation, and maintenance

NoBuyRent taps into Gen Z’s demand for flexibility, zero ownership hassle, and digital convenience.

What the Future Holds – Key Market Outlook

- Segment | 2025 Size | 2030 Projection | CAGR

- Co‑Living | ₹40 billion | ₹206 billion | ~35%

- Appliance Rental | – | USD 76.8 billion globally | 9.2%

- Car Rental | USD 2.74 billion | USD 9.29 billion | 14.5%

Conclusion

Asset‑light living is no longer just a trend — for India’s Gen Z, it's a lifestyle revolution. Driven by flexibility, smart spending, digital platforms, and sustainability, this generation is redefining the concept of ‘home’. For entrepreneurs and investors, this represents a thriving, high-growth market — from furniture and appliance rentals to co‑living and car access — creating opportunities for platforms like NoBuyRent to shine.